capital gains tax rate california

The IRS will charge you a capital gains tax on your California home sale and so too will the state of California through its Franchise Tax Board FTB. May 1 2020.

How To Calculate Capital Gains Tax H R Block

California is generally considered to be a high-tax state and the numbers bear that out.

. Because California does not give any tax breaks for capital gains you could find yourself taxed at the highest marginal rate of 123 percent plus the 1 percent Mental Health Services tax. The Tax Brackets In California Range From A Low Of Just 1 To A High Of 123. Ad Find Recommended California Tax Accountants Fast Free on Bark.

10 rows California is generally considered to be a high-tax state and the numbers bear that out. You owned and occupied the home for at least 2 years. If you have a difference in the treatment of federal and state capital gains file.

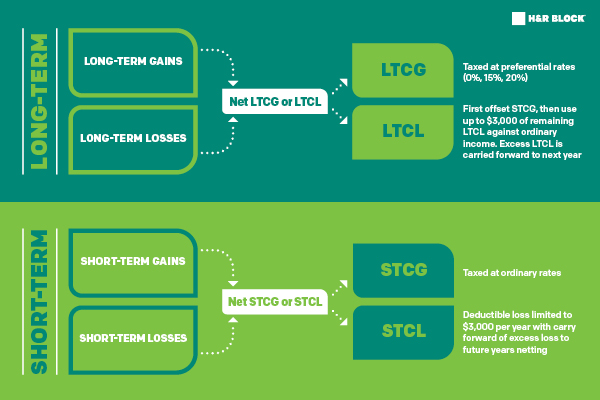

The capital gains tax rate is in line with normal California income tax laws 1-133. To report your capital gains and losses use US. It does not recognize the distinction between short-term and long-term capital gains.

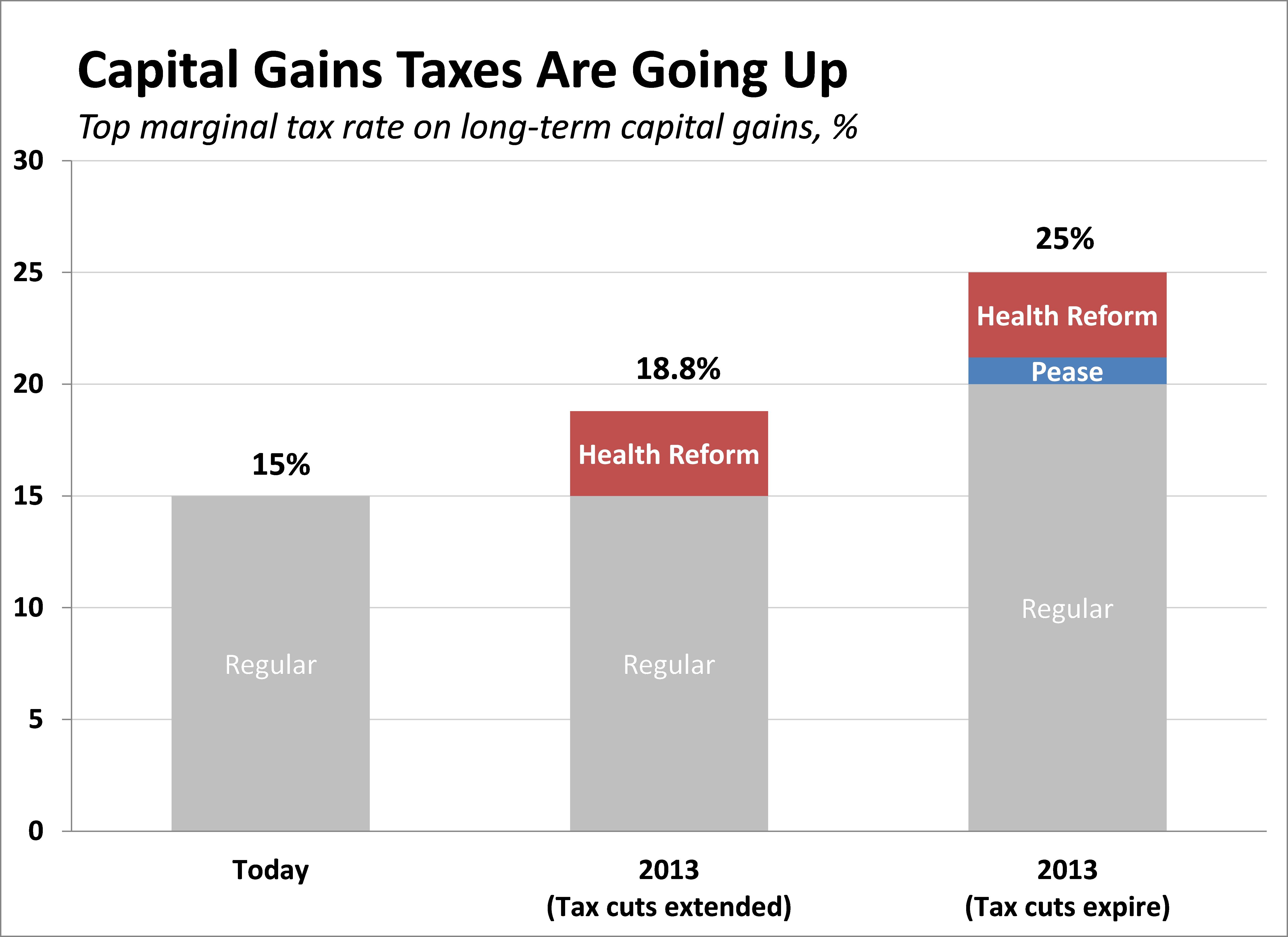

Add the 38 net investment tax under Obamacare and you have 238. 9 rows With California not giving any tax breaks for capital gains you could find yourself getting. Discover Helpful Information and Resources on Taxes From AARP.

The three long-term capital gains tax rates of 2018 havent changed in 2019 and remain taxed at a rate of 0 15 and 20. Any gain over 250000 is taxable. Kinyon Kim Marois Sonja K.

The golden state also has a. Long-term capital gains are gains on assets you hold for more than one year. The FTB sticks to IRS rules on capital gains taxes for the sale of a home and follows the same exemptions.

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. Its unique method of taxation based on the residence of the trusts fiduciaries and beneficiaries and. There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains.

These California capital gains tax rates can be lower than the federal capital gains tax rates which are. Instead capital gains are taxed at the same rate as regular income. Which rate your capital gains will be taxed depends on your taxable income and filing status.

How to report Federal return. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. You do not have to report the sale of your home if all of the following apply.

All capital gains are taxed as ordinary income. Theyre taxed at lower rates than short-term capital gains. Because California does not give any tax breaks for capital gains you could find yourself taxed at the highest marginal rate of 123 percent plus the 1 percent Mental Health Services tax.

You have not used the exclusion in the last 2 years. By paying 238 plus 13. Currently individuals making 254250 to 305100 a year pay 103 in taxes with the rate increasing to 133 for those making 1 million or more.

California does not have a tax rate that applies specifically to capital gains. California Trusts and Estates Quarterly Volume 21 Issue 3 2015 Californias income taxation of trusts has unpleasantly surprised many trust fiduciaries and beneficiaries. The capital gains tax rate for gains have a rate in line with normal California income tax laws 1 133.

This means your capital gains taxes will run. Your gain from the sale was less than 250000. California does not have a lower rate for capital gains.

Ad The money app for families. Any gain over 250000 is taxable. There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains.

See also New Movies 2022 Dvd Release Date. Your 2021 Tax Bracket to See Whats Been Adjusted. Individual Income Tax Return IRS Form 1040 and Capital Gains and Losses Schedule D IRS Form 1040.

California does not tax long term capital gain at any lower rate so Californians pay up to 133 too. California does not have a lower rate for capital gains. 27 2017mark ralstonafp via getty images California has.

4 rows The capital gains tax rate California currently plans for is one that can vary widely. In the state the effective average tax rate is 073 compared to the US. The capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and. This is maximum total of 133 percent in California state tax on your capital gains. The capital gains tax rate for gains have a rate in line with normal California income tax laws 1 133.

These California capital gains tax rates can be lower than the federal capital gains tax rates which are 0 15 and 20 for long-term gains assets held for more than a year. Ad Compare Your 2022 Tax Bracket vs. This is maximum total of 133 percent in California state tax on your capital gains.

Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. Simply put California taxes all capital gains as regular income. California taxes capital gains at the same rate as.

In california therefore the tax rate on capital gains for married people filing jointly is 93 percent for income between 117269 and 599016 and reaches a whopping 133 percent for income over 1198024. Thats the Greenlight effect. Download the app today.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Are Going Up Tax Policy Center

How To Offset Capital Gains H R Block

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

How Capital Gains Affect Your Taxes H R Block

How Does California Tax Your Capital Gains Financial Planner Los Angeles

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

How High Are Capital Gains Taxes In Your State Tax Foundation

How Does California Tax Your Capital Gains Financial Planner Los Angeles

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

2022 Income Tax Brackets And The New Ideal Income For Max Happiness